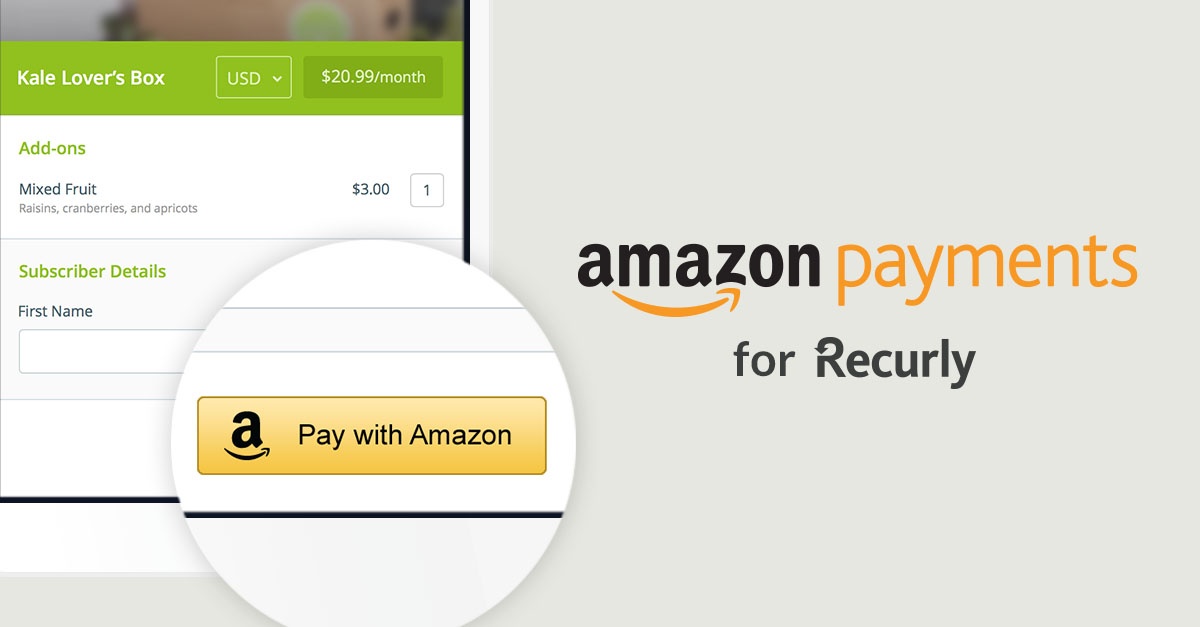

Amazon’s Conversion Rates - Make Their Results Your Own

A new study by Millward Brown Digital highlights yet another reason why Recurly’s Pay with Amazon can significantly boost sales: customer conversions. Most notably among Prime members, Amazon’s conversion rate is a whopping 74%. And for non-Prime members, the conversion rate is still at 13% - that’s four times the average conversion rate of 3.32% for online retailers. If anything, these conversion rates illustrate strong loyalty to Amazon. A significant consideration is Amazon Prime’s loyalty program which includes expedited shipping, instant unlimited access to streaming videos, music and books, and exclusive promotions proving that premium service plus loyalty is a winning combination. That’s probably why the service’s popularity has reached an estimated 25% of U.S. households and projected to grow to 52% by 2020, according to investment firm Macquarie. Why not leverage some these advantages of Recurly’s Pay with Amazon for your subscription business? You can reduce friction by relying on the information already stored in your customers’ Amazon accounts while adding subscription service to the mix.